Virginia law dramatically changed in 2023 with regard to uninsured motorist coverage, and it changed for the best. The change enabled people who had been hurt in car accidents to obtain more compensation for injuries that they sustained by modifying the existing statute. Unfortunately, the lobbying power of big insurance companies was considerable, and they created a carve out for themselves in the law. Utilizing this carve out, the insurance companies were able to offer up certain incentives, and thus hoodwink many unsuspecting motorists into getting less protecting than they were now entitled to. How, you ask? Read on.

What is Enhanced Uninsured Motorist Coverage?

In short, the big insurance companies like Allstate created a whole new set of terms by which are confusing unsuspecting motorists. We are going to explain what all this means.

The biggest issue is something call an insurance offset. Under the old law, the uninsured motorist carrier got an offset for whatever the at-fault driver’s insurance company paid. Under the new law, that offset was removed – unless an insured affirmative waived the new law.

But why would anyone waive this coverage? Well, mostly because people did not understand how uninsured motorist coverage (UM) and underinsured motorist coverage (UIM) worked before. The insurance companies decided that they were going to add the word “enhanced” to the current, in-force law, and make it seem like it was costlier to drivers.

The truth: enhanced uninsured motorist coverage, in Virginia, is just the new law. This is standard on all car insurance policies issues to drivers, and for vehicles, in Virginia.

Of course, the insurance companies wanted people to opt out of the new law, waiving its application (this is the carve out we spoke of). They began to throw money at people, saying that you could save $10 or even $20 a month by waiving this coverage.

NO!!!!!!!!! $20.00/month for 12 months is $240.00/year. Minimum UM/UIM

coverage in Virginia is $30,000 (which is what you would waive!), meaning

that you would have to drive without an accident for 125 years before you

saved on the deal!!!

We recognize that this may not really be bringing the point home, so let’s look at two identical car accidents with two different coverages to show how “enhanced” UM coverage works, and how waiving UM/UIM coverage can truly hurt you.

Example 1: Juan has “waived” enhanced UM coverage

Juan is commuting into DC from Woodbridge. He is on I-395 by Seminary Road. Traffic is stop and go, and he is rear-ended by an an inattentive driver. He is hurt, is transported to the hospital, and by the time he is discharged from medical treatment, he has over $30,000 in medical expenses. Unfortunately, the driver who hit Juan only had the minimum insurance coverage required under Virginia law ($30,000). Juan has waived his “enhanced UM coverage”, and also has a minimum insurance policy ($30,000).

In Juan’s case, his claim is against the at-fault driver. Because his medical expenses are so high, he could have a significant personal injury case. But there is only $30,000 of available coverage. Under normal circumstances, when the at-fault driver does not have enough insurance coverage to compensate you for your injuries, we look to your own uninsured/underinsured motorist coverage to help make up the difference.

Unfortunately, the old law gives the UM/UIM carrier an offset, or credit for the at-fault driver’s coverage, like this:

$30,000 UM/UIM – $30,000 at-fault coverage = $0

So, even though Juan’s case is worth more than 30,000, $30,000 is the most he is going to be able to recover, barring any assets or other coverages.

Example 2: Tameika has enhanced UM coverage

Tameika is commuting into DC from Woodbridge. She is on I-395 by Seminary Road. Traffic is stop and go, and she is rear-ended by an an inattentive driver. She is hurt, is transported to the hospital, and by the time she is discharged from medical treatment, she has over $30,000 in medical expenses. Unfortunately, the driver who hit Tameika only had the minimum insurance coverage required under Virginia law ($30,000). Tameika has “enhanced UM coverage”, and also has a minimum insurance policy ($30,000).

Tameika’s claim is against the at-fault carrier, and so her claim is against that driver and his insurance carrier. That carrier offers up their full-policy limits of $30,000. Tameika then can press her claim for the balance of her damages through her own UM/UIM coverage.

Tameika now has more available insurance for her potential recovery:

$30,000 at-fault coverage + $30,000 UM/UIM = $60,000 available

Tameika has the better change of being compensated fairly for her injuries.

How do I know what insurance coverage I have?

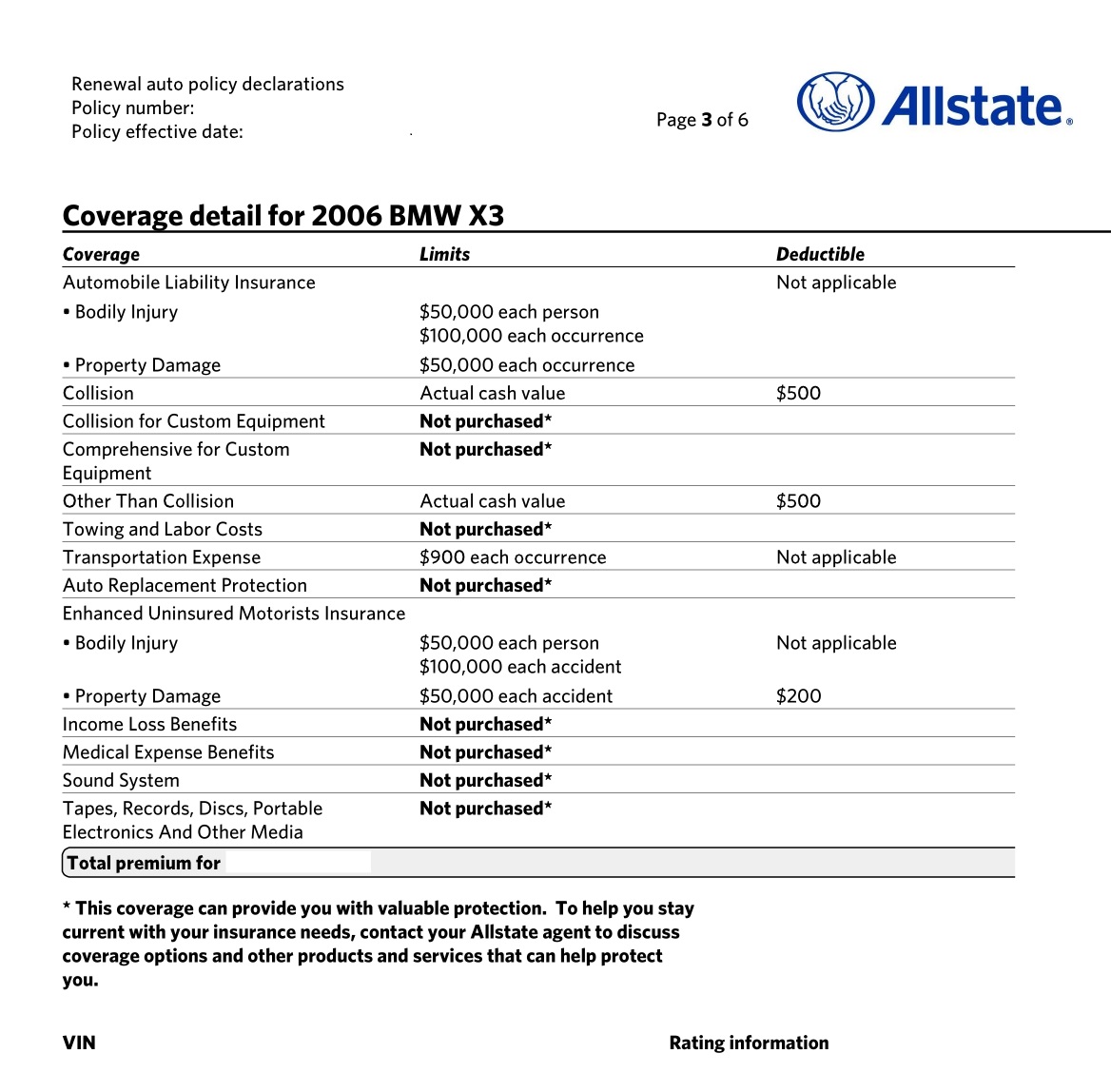

Your insurance coverage will be outlined on your policy declarations. Some insurance companies call this a declaration sheet, some call it a declaration page: it is the same thing. It is a line-by-line list of what you have, and are entitled to. Every time you renew your policy, you get this document, usually in the first 10 pages of the papers they send you.

Beware Insurance Companies and Always Talk to a Virginia Car Accident Attorney!

Blaszkow Legal represents drivers, not insurance companies. Our job is to fight for you, and for your best interests. Insurance companies only work for their stockholders. Insurance agents, the ones who are actually selling policies, may not understand subtle distinctions of the law, and even if they did, cannot give you legal advice.

If you have questions, ask! We are happy to review your case insurance policy and let you know what sort of coverage you have, and what you may want to get.

If you have been hurt in a car accident that was not your fault, then call the team that has battled for injured people throughout Virginia, Maryland, and DC for over 40 years. Call 703-879-5910 for a free consultation!

Here is a sample Allstate Declaration Page (or “Dec Sheet”), showing “enhanced” uninsured motorist coverage: